how to pay late excise tax online

Avalara solutions can help you determine excise tax and sales tax with greater accuracy. Based On Circumstances You May Already Qualify For Tax Relief.

Businesses impacted by recent California fires may qualify for extensions tax relief and more.

. Please visit our State of Emergency Tax Relief page for additional information. Past Due Excise Bills Municipal Lien Certificates Tax and utility payments can also be paid by calling Brooklines 24-Hour Payment Line at 844-234-3779 convenience fee charges apply. Businesses impacted by recent California fires may qualify for extensions tax relief and more.

The excise rate is 25 per 1000 of your vehicles value. TTB Excise Tax Returns and payments must be mailed to. If you wish to use the pay-by-phone service please call toll-free.

Excise Bills are issued numerous times throughout the year when received from the Registry of Motor Vehicles and are due 30-Days after the issue date. How to file an excise tax abatement Need to Know. Based On Circumstances You May Already Qualify For Tax Relief.

Ad Avalara excise tax solutions take the headache out of rate determination and compliance. Do Your 2021 2020 any past year return online Past Tax Free to Try. Please visit our State of Emergency Tax Relief page for additional information.

It is charged for a full calendar year and billed by the community where the vehicle is. Late returns or payment are subject to penalties and interest. Ad See If You Qualify For IRS Fresh Start Program.

Once you enter your NAME please CLICK one of the options below to continue entering specific information. For Vehicles on the road. The city or town where the vehicle is principally garaged levies the excise and.

If your vehicle is registered in. Free Case Review Begin Online. It is charged for a full calendar year and billed by the community where the vehicle is usually garaged.

If you dont make your payment. Dont file a second return. Easy Fast Secure.

To find out if you qualify call the Taxpayer Referral and Assistance Center at 617-635-4287. Tax Facts 37-1 General Excise Tax GET Other Tax Facts on General ExciseUse Tax. We allow for estimated payments extension payments payments with a tax filing license renewal payments bill payments and payments for various fees.

Tax Filing Is Simple And Free For Those Who Qualify With TurboTax Free Edition. Massachusetts Property and Excise Taxes. The service fees for pay-by phone are the same as indicated above for paying online.

All Massachusetts residents who own and register a motor vehicle must pay the motor vehicle excise annually. What happens if you pay your excise tax late. Free Case Review Begin Online.

This includes Forms 720 2290 8849 and faxed requests for expedite copies of Form 2290 Schedule 1. Ad Do Your 2021 2020 2019 2018 Taxes in Mins Past Tax Free to Try. There are many different methods to choose from including credit card.

Ad File For Free With TurboTax Free Edition. Ad REPAY has industry-leading payment security including PCI DSS compliance. If you have a California sellers permit you must pay the use tax due on business related purchases with your sales and use tax return in the period when you first used stored or.

Tax on Property vehicles. Once completed click the NEXT button within the option you choose. See If You Qualify and File Today.

An Introduction to the General Excise Tax PDF 20 pages 136 KB March 2020. Learn more about REPAY and how we can be a one-stop shop for your payments. Easy Fast Secure.

Ad See If You Qualify For IRS Fresh Start Program. Paper excise forms are taking longer to process. The New York State Department of Taxation NYSDOT offers several ways to pay excise tax online.

For forms or more detailed instructions contact your TTB Specialist at 1-877-882-3277 or Alcohol and Tobacco Tax and Trade Bureau TTB National Revenue Center 8002 Federal Office. Documentation and Managerial Involvement - Excise examiners must use Administrative Lead Sheet E500 Penalty Check Sheet located in the Forms Library of the. Here you will find helpful resources to property and various excise taxes administered by the Massachusetts Department of Revenue DOR andor.

ATL - Lates Tax Financial News Updates. If you need help getting. Calculating the Excise 25 per 1000 of value The excise rate is 25 per 1000 of your vehicles value.

Form 720 Excise Taxes Instructions And Guidelines

3 11 23 Excise Tax Returns Internal Revenue Service

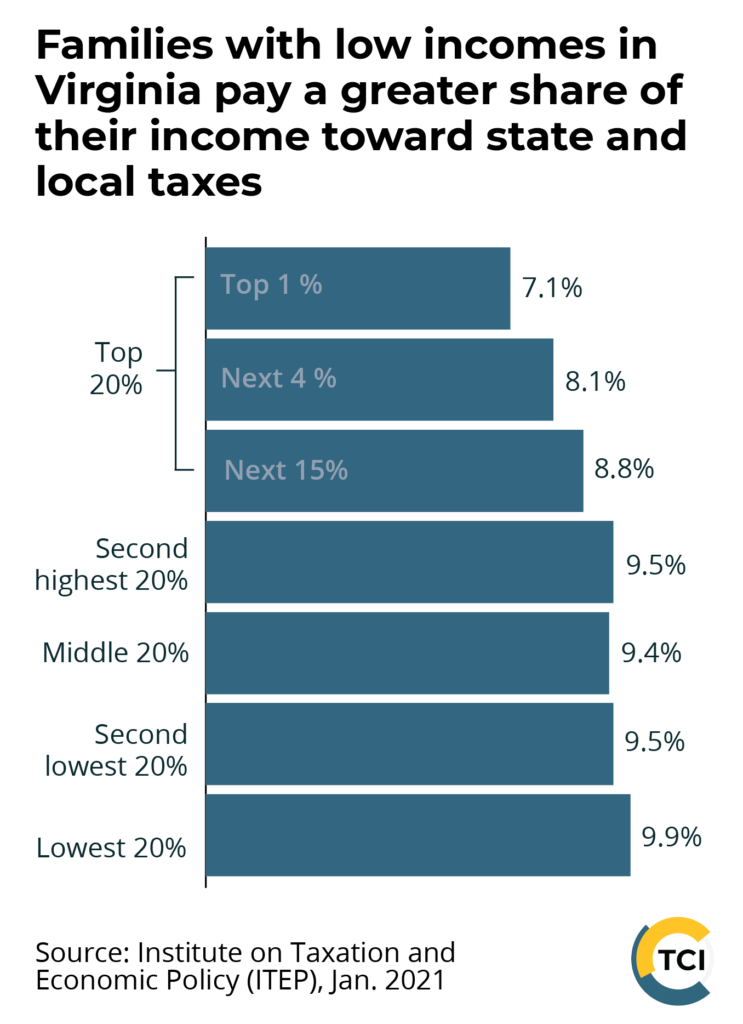

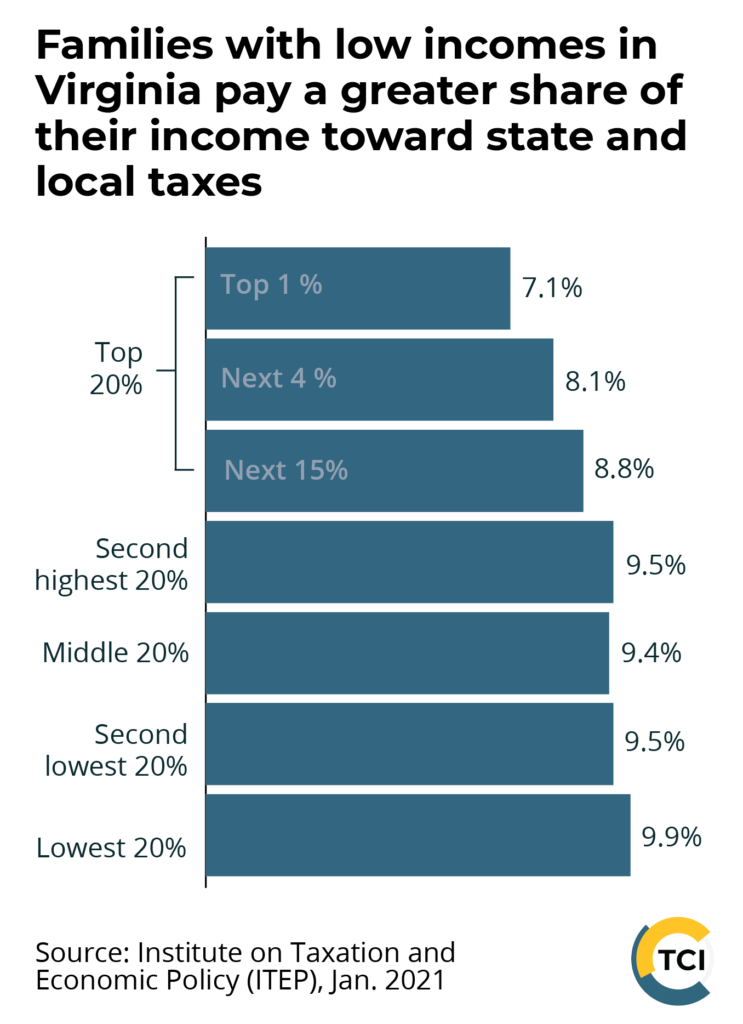

Tax Policy In Virginia The Commonwealth Institute The Commonwealth Institute

Motor Vehicle Excise Information Methuen Ma

The Real Deadline For Depositing 401 K Deferrals And What To Do If You Re Late Www Patriotsoftware Com Payroll Software Deposit Employment

Tax Collector Frequently Asked Questions Town Of North Providence Rhode Island

3 11 23 Excise Tax Returns Internal Revenue Service

Look Up Pay Bills Town Of Arlington

Online Bill Payment Town Of Dartmouth Ma

2021 Motor Vehicle Excise Tax Bills Fairhavenma

Excise Tax What It Is How It S Calculated

Federal Excisetax Form2290 Quarterly Federal Excise Tax Form720 International Fueltax Agreement Report Ifta All These Tax Deadline Tax Filing Taxes

Tax2290 Com Taxexcise Com Is A Proud Member Of Tennessee Trucking Association No Need To Manually Fill In Tax Forms Doing Compl Irs Truck Driver Trucks

New Gst Registration Procedure Gst Number Blog Tools Registration Confirmation Letter